The Modern Financial System is A Debt-Based Pyramid Scheme & An Investment-Based Ponzi Scheme With Extra Steps…

After a couple of years of studying ₿itcoin and the US Dollar that I was raised to trust like it was some faceless god, I eventually started valuing everything in Bitcoin’s Satoshis instead of the US Dollar.

The biggest reason wasn’t because of Bitcoin either. It was the US dollar’s system that did it to me. Once I learned what the system was and how it functioned, I could no longer value anything in dollars after realizing how fast they were exponentially losing value.

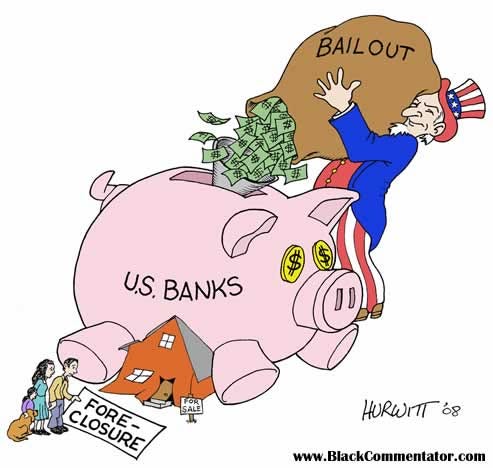

The US dollar is a system that is burning up its own value with every new dollar that is digitally issued and shoved into the bank accounts of the top 1% of the world. It is shoved into their accounts whenever they need to get a new bank bailout loan or corporate bond loan.

They then take that new money and freeze it into their own portfolio’s asset holdings. Jumping ship from the dollar while the loan/money printing process that got them those dollars, melts away the buying power of everyone else’s US Dollar savings.

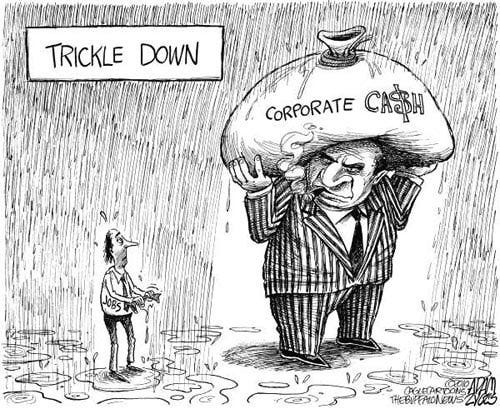

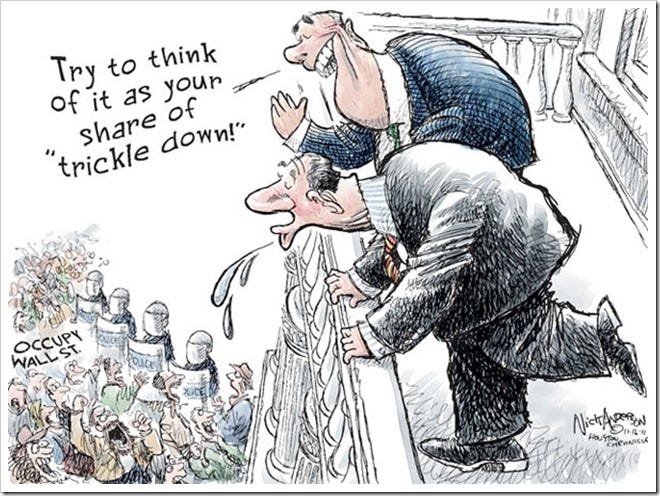

This process leaves almost none of that newly printed money liquidity to trickle down to those at the bottom that are relying on the dollar.

Dollars that are perpetually being devalued thanks to the digital printing of trillions of new dollars, trillions of new dollars that are issued through loans acquired by the top 1% for their asset hoarding greed.

And we wonder why the wealth inequality is getting so bad with all this loan welfare. Loan welfare for the top 1% where they get a majority of the newly printed cash to then play musical chairs with, in their asset market of choice.

RJ Matson ©

Distributed to subscribers for publication by Cagle Cartoons, Inc.

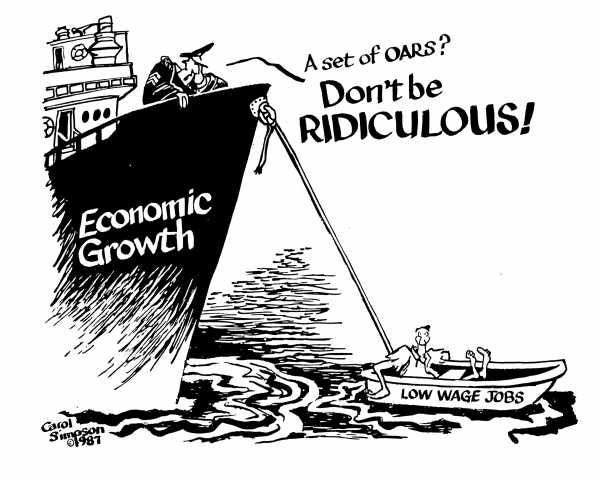

They got most of the now 35% of all US dollars in existence that were digitally printed out of thin air last year during the pandemic. Just as they always get a majority of the new digitally printed cash every year to hoard in their assets, all while giving employees the bare minimum. Not even the bare minimum to survive anymore, but the bare minimum they can get away with since minimum wage isn’t even enough to afford the new rising costs of rent.

That happens because our cash is created with every new loan that gets issued in our current monetary system, and the top 1% can afford to get the largest loans out of all of us. Some of them can even force the government to give them large loans, which in turn force new money to be digitally printed. Devaluing the rest of the dollars in circulation in the process.

US Dollar Inflation visualized at the top Vs Bitcoin’s deflation visualized at the bottom:

The government is often forced to give out these massive corporate loans that cause the printing of new money which devalues everyone’s US Dollar savings. There are situations like this that we see every couple of years where banks need to get bailed out because their corrupt systems go bust and start falling apart, further increasing the debt imbalance on the US Dollar’s balance sheet.

The Dollar’s system in which new dollars are generated through loans is basically a loan-based, asset-hoarding Pyramid Scheme with extra steps. One that is falling apart at increasingly faster rates with every uptick in inflation, and no uptick in wages thanks to the wage stagnation caused by corporate greed. Corporate greed likes to test how little they can get away with paying people while avoiding an uprising.

It falls apart further with every new digitally printed dollar that forces them to print even more dollars to pay off old debts, which in turn creates larger debts in the process. Repeating this bleeding debt-money-creation-cycle that is causing the inflationary purchasing power loss of the US Dollar to grow exponentially faster over time.

All this so one percent of the population can hoard enough assets to live like financial gods. With enough money to fly their rockets to the heavens, and still have more money left over than they can ever possibly spend in their lifetimes. But sure, some of them are promising to give it all away when they die, so they tell us that it’s okay for them to do it.

Their corrupt schemes get more fun too on the other end of this debt-money-creation issuing equation: The investor end.

On the investor end, the government pays off debts to old national bond investors with the money they receive from new national bond investors that are investing into the government’s bond market system.

That means that the US pays off old investors of the nation with the money they receive from new investors into the nation’s bond system. Sound familiar? In the dictionary, this is called a Ponzi Scheme. I call it “a Ponzi Scheme with extra steps.”

Side note: These government bond investors are supposed to be the ones funding the new government bond loans. But there are not enough investors to do that since most people today are wage slaves. So the investors that are able to invest can only afford to fund a small percentage of the massive corporate-government loans that get approved every year. Meaning the rest is new money printed out of thin air with each loan that exceeds the national bond investment cash inflow.

This system, in which they print the new money that devalues the purchasing power value of everyone else’s US Dollar savings, while at the same time freezing the new money supply away in corporate assets that prevents it from trickling down and circulate throughout the economy, is how a wage slave working class is created.

A working-class with wages so low that they can never save any substantial amount of money before the dollars in their savings are devalued beyond any meaningful utility. Usually forcing them to have no other option but to take on unpayable debts just to get by and get anything they need in life like a house, a car, food, or rent, or even to pay emergency medical bills, etc.

The national bond investor end of this equation is what allows the government the front they need to be able and print the massive amounts of money that they do. Money that they then loan to Wall Street every year who then freezes it into their asset bags.

You know, like a money-laundering operation works. Except, instead of the money coming in from cartels or nefarious businesses with offshore banks accounts to then be washed through their fake businesses and stored in legal assets, it’s just being printed out of thin air by the FED. Adding more dollars to the overall circulating dollar supply, while reducing the value of everyone else’s savings who save in US dollars and/or fiat currencies like it that rely on the dollar.

Have you felt that something was off with our financial system in this country? That might be because you subconsciously noticed that the system unfairly flows the stream of new money to the top one percent. While at the same time leaving those at the bottom with less money and only higher debts every year that perpetually grows and forces them to work all their lives.

In lamens terms, the system is a debt-based Pyramid Scheme with extra steps, fronted on the other end by an investing-based Ponzi Scheme with extra steps.

It’s a big club, and you’re not invited.

Everyone else might as well be a West World robot-like wage slave whose time can be rented and traded with a paycheck like a deck of trading cards.

George Carlin said it best:

It’s two sides of the same rotten apple, and it is starting to rot down to the core. Two corrupt practices that the government takes other companies and individuals down for when they’re caught doing it. Maybe they just don’t like the competition. Maybe it’s Maybelline. (Sorry, couldn’t help myself!)

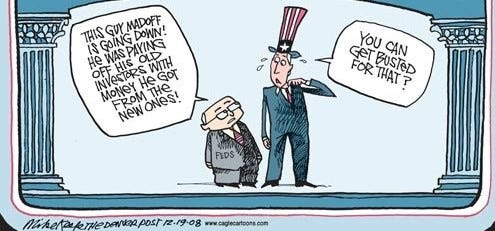

When Bernie Madoff gave his first interview from jail after being caught running a Ponzi scheme, he told the press: “Why are you even talking to me; the federal government is running the biggest Ponzi scheme in the world!”

If there was one thing Bernie Maddoff was an expert in, it was Ponzi schemes. Game recognizes game.

If my explanation of how the financial system is one giant Ponzi Scheme is still not clicking, then maybe this guy’s explanation with a bit more detail can help. He’s a man too dumb to understand Bitcoin, but thankfully, he has just barely enough brains to help explain the giant Ponzi Scheme that is the cracking financial system:

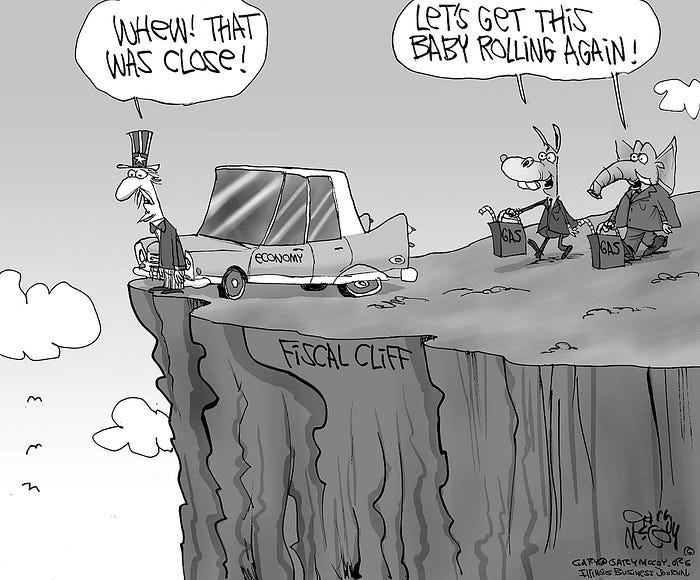

All this is inching the US Dollar closer to a cliff of hyperinflation, A financial cliff drop in the dollar’s purchasing power that most of us now have a high probability of seeing in our lifetimes.

When we compare where our debt to balance ratio is today to other countries in history who have been where we are now. Each of those countries historically fell into hyperinflation within 30 years from when they were at the point we’re at now. Unsustainable increases in inflation rates, which caused a loaf of bread to cost their citizens upwards of a million dollars in their currencies.

Where Venezuela is today. Where Argentina, Zimbabwe, and so many more countries are today. All countries who are already experiencing this ahead of us, who 30 years ago were where we are today in our rates of inflation and national debt balance sheets.

It happened to Germany too before they got desperate and fell into wars from the pains of those economic collapses. Wars that were started as last-ditch efforts to save their country.

The falls of these countries’ currencies always started off with a slow ramp-up in speed like what we had in 2008 when satoshi first noticed it during the 2nd bank bailouts(That’s right, the first bank bailouts were done in the late ’90s, and almost nobody paid attention). Next follows a moderate to fast ramp-up in speed like we are in now. All finally resulting in one giant uncontrollable drop in the values of their currencies within 30 years. A value loss rate of inflation that never ended once they fell into hyperinflation.

And with the US Dollar being the reserve currency of most countries today, then its collapse will drag the whole world down with it if they all don’t hedge themselves properly to protect themselves against the dollar’s approaching collapse.

El Salvador is a great example of that kind of hedging against the dollar that other countries appear to be taking notes on. If you don’t know, El Salvador made Bitcoin a legal currency and treasury reserve asset in their country to protect themselves against the dollar’s increasing rate of inflation.

The signs of the dollar’s collapse that is exponentially picking up speed is obvious when you look at all countries that are experiencing hyperinflation today. Countries that relied on the dollar until its increasing rates of inflation failed them and their currencies.

This last video, while it may be long and it might not be a comedic explanation. It does a much better job at explaining the debt problem we have today than I. It also does a better job at explaining how every country in history that has been where we are today, was only 30 years away from hyperinflation and complete economic collapse:

Because of all that, I’m more afraid to save dollars long-term than I am afraid to save Bitcoin. Especially after reading the charts on https://wtfhappenedin1971.com/

It really paints a good picture of how we started heading down this increasing rate-of-inflation rabbit hole after Nixon ended the gold standard. Something that even Nixon said was supposed to be temporary. Well, it’s been 50 years since then and the dollar has only lost what? Over 99%+ of its value when compared to things like houses, Cars, Food, Rent. But sure, it’s temporary. I’m sure Tricky Dick will come back from the grave one day to tell us it’s time to head back to the gold standard./s

If you want to know why I’m bullish on Bitcoin, and why I started using it as my primary savings ever since learning about its system vs the dollars? Then check out this article:

My Best Attempt To Simplify The Math Of A $50 Million Dollar Bitcoin [1₿=$50 Million]

Want a way to earn ₿itcoin with every dollar you spend? Then check out the new BlockFi Credit Card here! Earn 3.5% back in ₿itcoin for the first 3 months, then 1.5% back in ₿itcoin on every purchase after that. This is the only place where the Credit Card rewards for your purchases can one day grow to be more valuable than whatever you purchased to get the ₿itcoin Credit Card Purchase Rewards: https://blockfi.com/?ref=b19c0bcb

Check out these platforms where you can earn Interest on your parked Bitcoin and Cryptocurrencies, making your cryptocurrencies work for you. Because as Warren Buffet says, “If you don’t find a way to make money while you sleep, you will work until you die”: https://linktr.ee/Investla

Follow me on Instagram: https://www.instagram.com/investlayt/

Subscribe on YouTube: https://www.youtube.com/c/Investla

Tweet at me on Twitter: https://twitter.com/InvestlaYT

Check out my Tiktok: https://www.tiktok.com/@investla

Follow me on Facebook: https://www.facebook.com/Investla

I’ll leave you with this Merch NFT Collection of the Bitcoin Reverso card artwork that I made for the Bitcoin and Cryptocurrency communities. In case anyone wants to collect them:

https://opensea.io/collection/inflation-bitcoin-reverso

Make an offer, I’ll be accepting offers from readers. Comment your NFT wallet address below too if you want a free NFT gift.

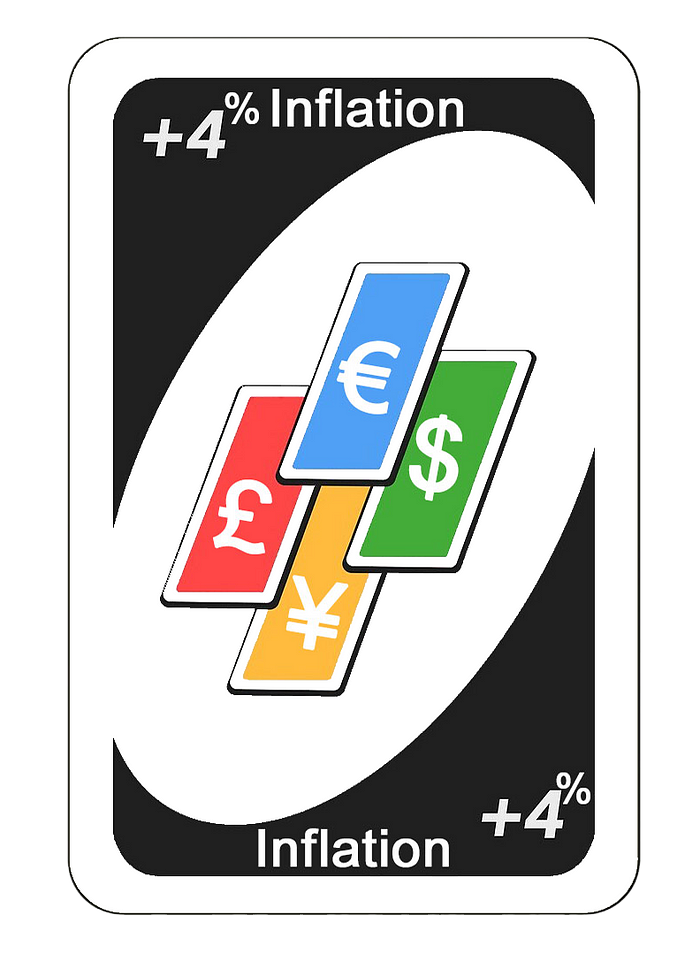

NFTs:

Description:

“When activated, every player loses 4% inflation across all their fiat currencies”

Description:

“Use this card to reverse the effects of inflation of any currency”

Fiat Inflation Card Vs Bitcoin Reverso Card Set

Description:

A rare collection of 2 cards that play a vital role in every HODL’rs fundamental understanding of finite, infinitely divisible, Bitcoin vs infinitely printed fiat currencies.

This set of cards portrays the message of Bitcoin’s long-term calculation that every HODL’r understands and realizes once they become a HODL’r.

The equation of: (Infinitely Printed Fiat Currency+Time)÷(A network of 21 Million, Finite, Infinitely divisible[through second-layer networks like the lightning network] Bitcoin).

It takes ten thousand hours of research to even understand the implication of that equation, but this NFT Meme helps get that understanding across a little bit quicker. If not in the technical sense, then, in a basic level understanding sense. A start to get one on the path of curiosity to one day becoming a HODL’er, and a DCA seller of their paper debt chains that do nothing but melt away the financial energy of their work, making the buying power of their savings worthless perpetually over time.

If you don’t have an Open Sea account, sign up for one here:

Bitcoin & Cryptocurrency Donation Tip Addresses:

BTC: 3DoZtWkXAW8ha3Si2xGeZu3LZMwkSbCXsb

ETH: 0x2bbff5a0007433a4157300d46a83acdfcc45af13

LTC: MQs9oyG3N9Q2vkRz95yX5Han2ut3p5erxW

LINK: 0x2bbff5a0007433a4157300d46a83acdfcc45af13

BAT: 0x2bbff5a0007433a4157300d46a83acdfcc45af13

Join Coinmonks Telegram Channel and Youtube Channel get daily Crypto News

Also, Read

- Copy Trading | Crypto Tax Software

- Grid Trading | Crypto Hardware Wallet

- Crypto Telegram Signals | Crypto Trading Bot

- Binance Trading Bots | OKEx Review | Atani Review

- Best Crypto Trading Signals Telegram | MoonXBT Review

- How to buy Shiba(SHIB) Coin on Bitbns? | Buy Floki

- CoinFLEX Review | AEX Exchange Review | UPbit Review

- 10 Best Cryptocurrency Blogs | YouHodler Review

- Best Crypto Exchange | Best Crypto Exchange in India

- Best Crypto APIs for Developers

- Best Crypto Lending Platform

- Free Crypto Signals | Crypto Trading Bots

- An ultimate guide to Leveraged Token